Submitting Orders

Using the order entry

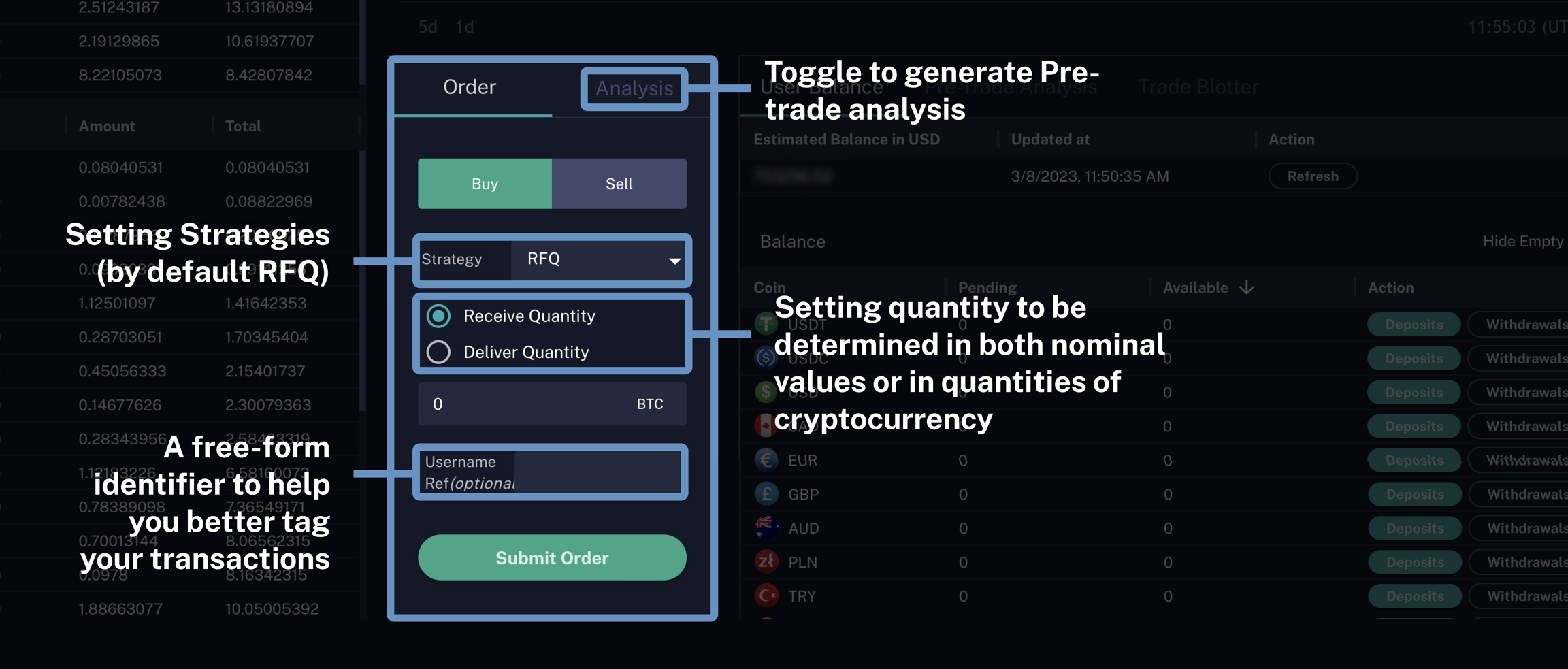

The Order Entry window on our dashboard allows users to place orders for all available trading pairs.

Users must first select whether they are entering an order to 'Buy' or an order to 'Sell'. Different trading strategies are available from the "strategy" dropdown, with RFQ set as a default selection. Trading strategies and their required fields are further covered in the Order Types / Strategies subpage.

Users can also indicate whether they want to receive a specific quantity of the traded asset or whether they want to deliver a specific quantity of the traded asset by choosing the 'Receive Quantity' or 'Deliver Quantity' option (e.g. You can purchase X bitcoin with $25,000 USD OR you can purchase 1 bitcoin with X USD).

The UsernameRef input field is programmed to be used as a free-form memo field to help you tag your trades.

Clicking on the 'Analysis' tab at the top of the Order Entry window will bring you to our pre-trade analysis tool. Here you can see the estimated price impact of your trade. This functionality is further covered in Pre-Trade Analysis.

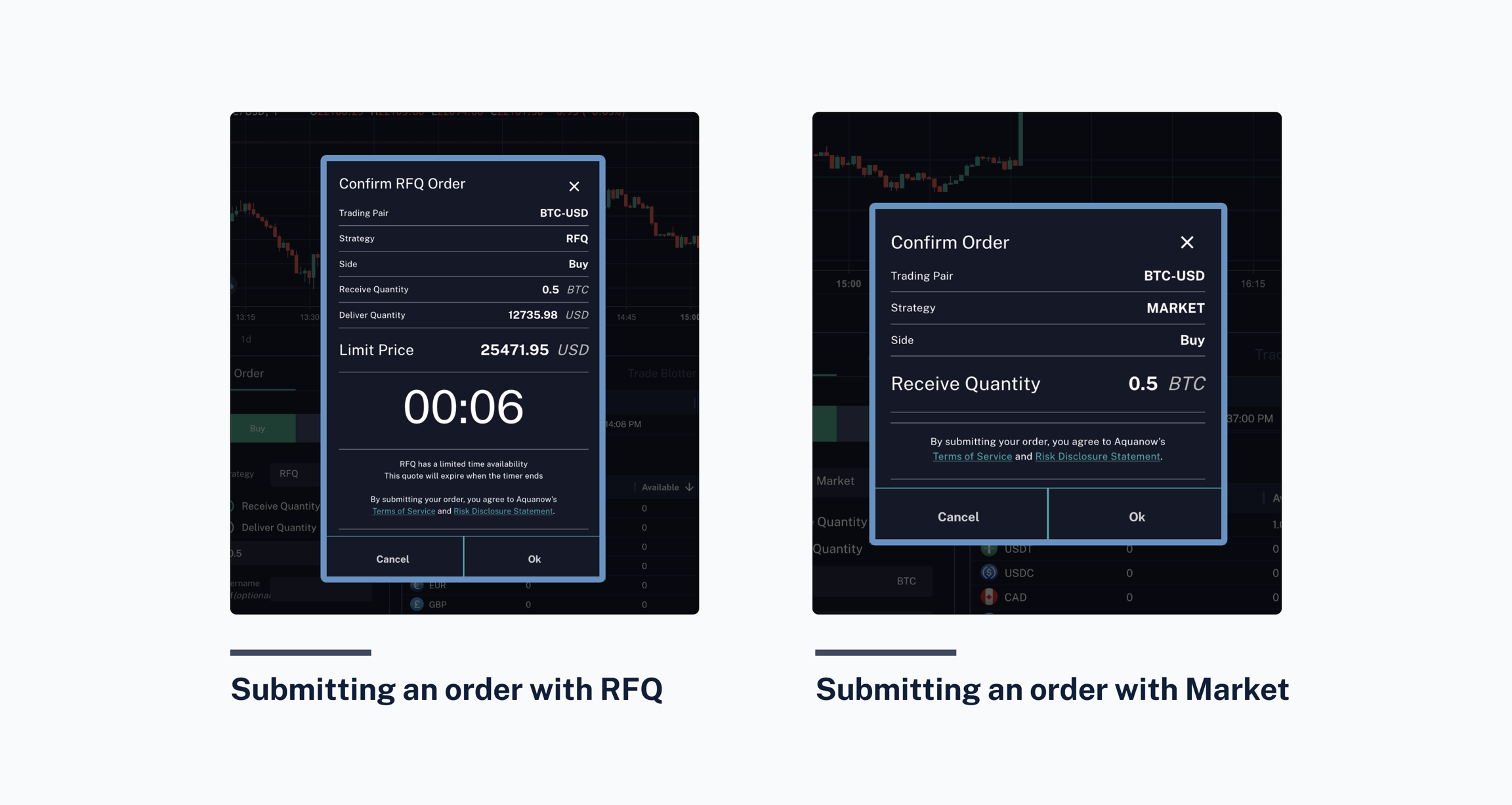

When submitting an Order, you will be prompted to confirm the request. A confirmation modal will highlight the critical order details, and you will have the option to submit or cancel the order request by clicking "Ok" or "Cancel" buttons. For RFQ orders, the modal also displays an 8 second quote timer. To submit the RFQ order you must click "Ok" before the quote expires, otherwise the order is considered expired.

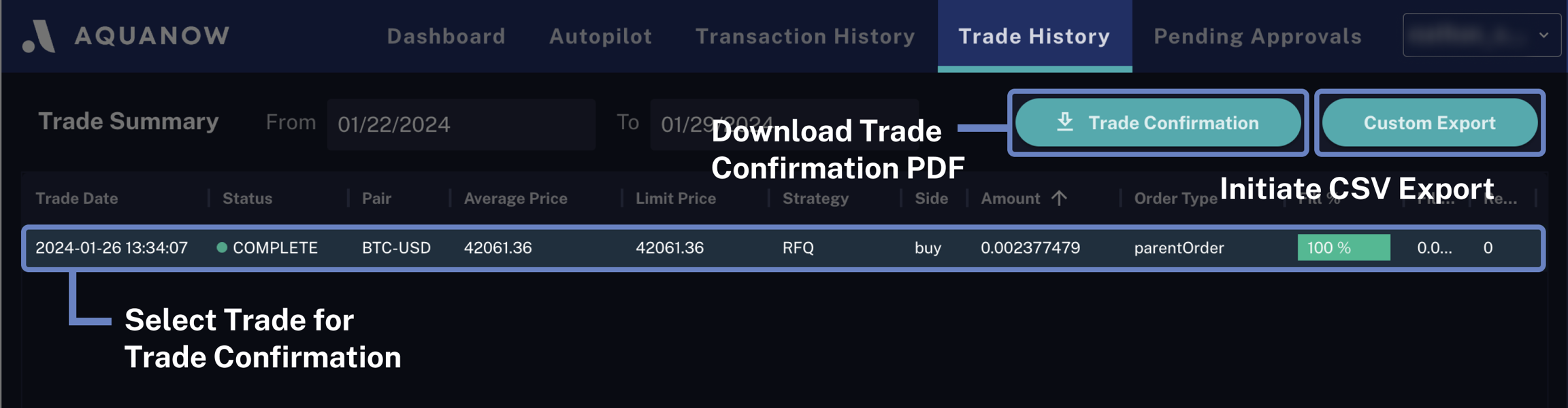

Once a user submits the order, the order/execution will appear in the Trade Blotter on the dashboard as well as the "Trade History" tab.

Users can export their trade history, or generate a trade confirmation PDF for a specific trade. This is further detailed in the Trade Management page.